Swaps

On its OTC IRS derivatives segment, BME Clearing admits Interest Rate Swap (IRS), as well as Forward Rate Agreements (FRA) and Overnight Indexed Swaps (OIS) for clearing.

This segment is compliant with the “clearing obligation” regulation, which make it compulsory for financial firms, insurance companies and other non-financial institutions to clear through a CCP all the Interest Rate Swaps with certain features. BME Clearing will cover all the Euro-denominated contracts affected by the new regulation.

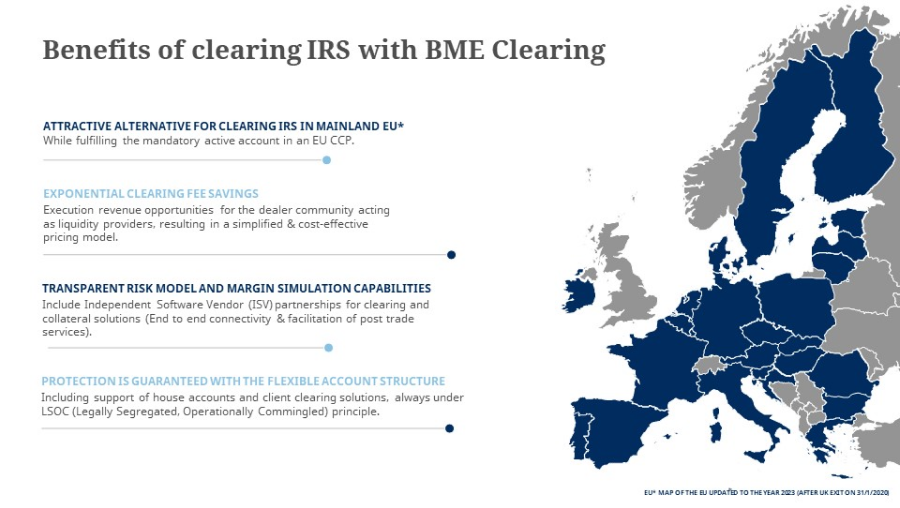

With this segment, clients of BME Clearing stand to benefit as they are able to comply with the clearing obligation at a reasonable cost while also achieving efficiencies in capital consumption derived from using a CCP for clearing their trades, instead of taking on counterparty risk in their bilateral transactions, which involves greater capital consumption.

Factsheet IRS Clearing Services

IRS Partnership Programme

We are also offering a IRS partnership programme providing revenue sharing opportunities to participants. Furthermore the partnership program will enhance liquidity on our platform and increase the benefits to all counterparties at BME Clearing.

For more information about our IRS Partnership Programme please contact: sixclearing-sales@six-group.com