HVAR

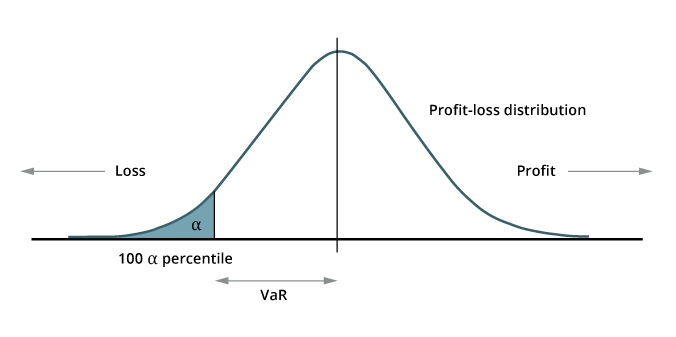

Value-at-Risk (VaR) is a statistical measure that quantifies the maximum expected loss given a time horizon and assuming a confidence level.

In the case of the Swaps Segment and the xRolling FX contracts of the Financial Derivatives Segment, BME CLEARING uses an Historical VaR model (HVaR) combined with Expected Shortfall (Tail VaR).

The HVaR uses historical data and scenarios.

The Expected Shortfall or Tail VaR is the expected value of the losses subject to being higher than a given level, in this case, the VaR. It would be the average of the losses within the tail of the distribution, that is to say superior to the VaR.

Between the advantages of using an HVaR model are:

- greater capital efficiency (generates greater offsetting)

- has greater accuracy by benefiting from a greater correlation and diversification effect

- greater robustness and

- greater flexibility, with the possibility to be applied to new products

For further detail about the calculation of the Initial Margin using HVaR, please check our “Procedure for Margin Calculation" Circular of the relevant Segment.